1990 E. Grand Avenue

2018.

/s/ Ken McBride

Ken McBride

Chief Executive Officer

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement | |

| o | Definitive Additional Materials |

| o | Soliciting Material pursuant to §240.14a-12 |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing party: |

| (4) | Date filed: | |

1990 E. Grand Avenue

2018.

11, 2018

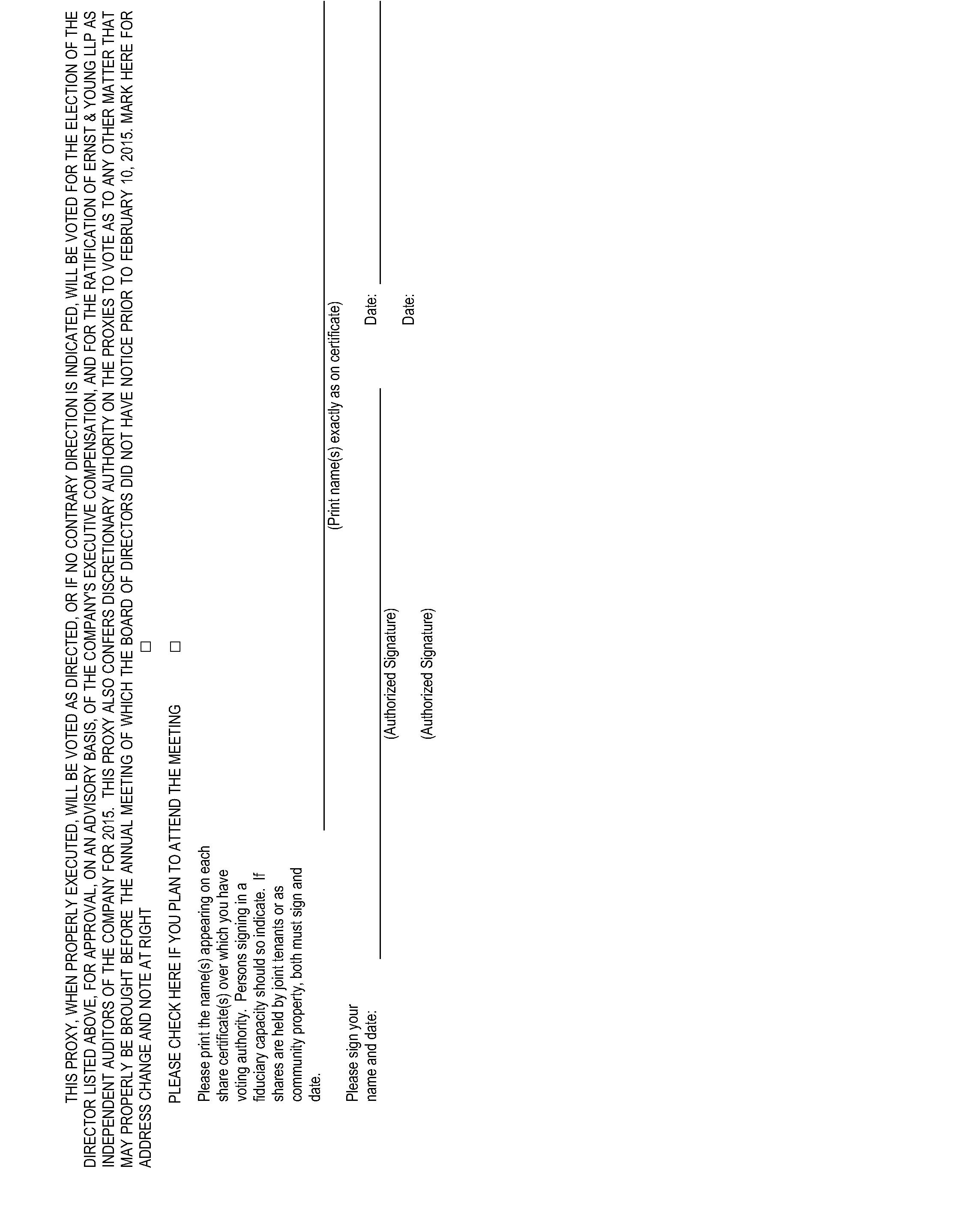

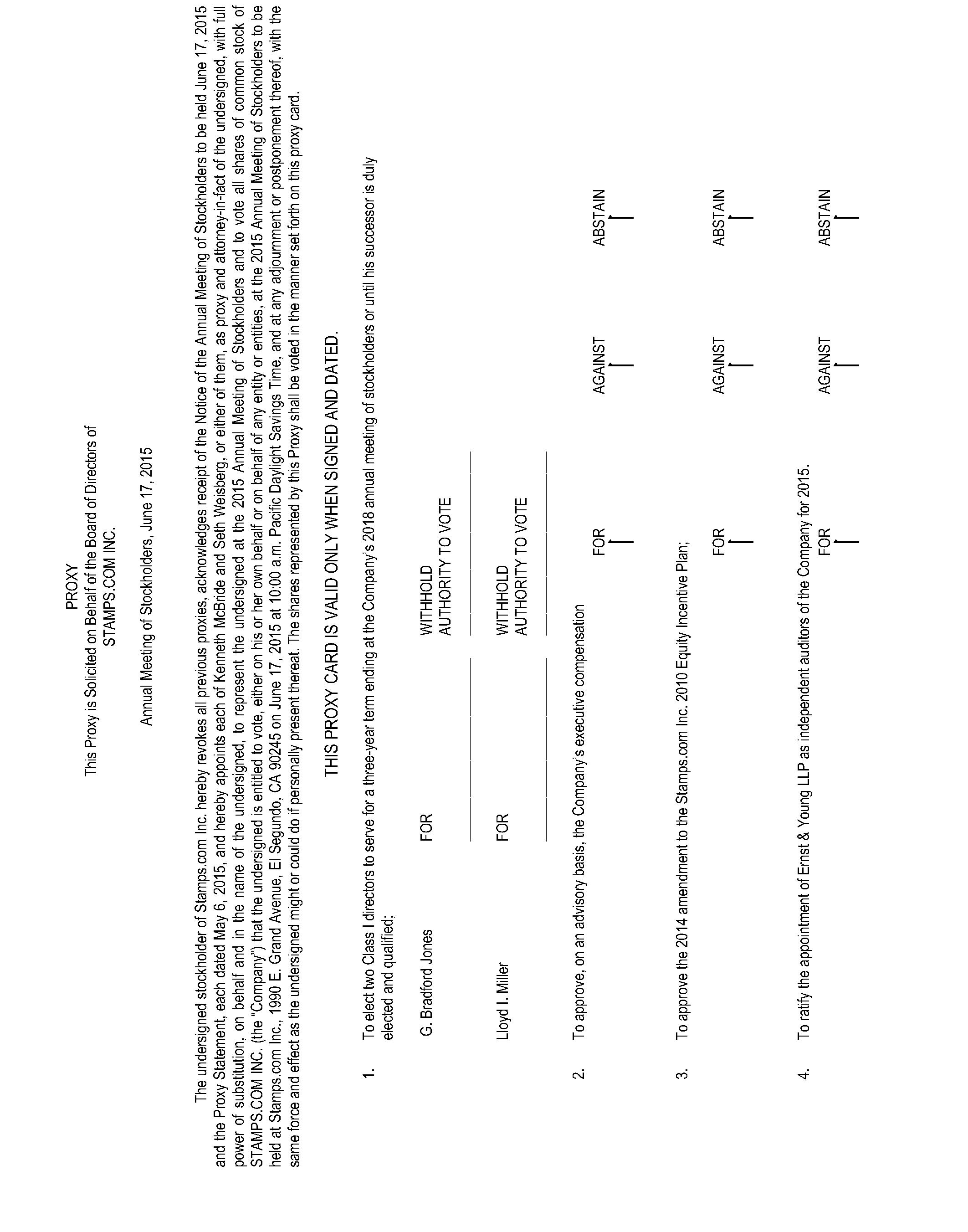

| 1. | To elect |

| 2. | To approve, on |

| 3. | To approve the |

| 4. | To ratify the appointment of Ernst & Young LLP as our independent auditors for |

Important Notice Regarding Availability of Proxy Materials

for the 20152018 Annual Meeting of Stockholders to be Held on June 17, 2015

11, 2018

11, 2018

3, 2018.

2018.

1

names that are beneficially owned by others so that they may forward this solicitation material to such beneficial owners. In addition, we may reimburse such persons for costs incurred in forwarding the solicitation materials to such beneficial owners. The original solicitation of proxies by mail may be supplemented by a solicitation by telephone, e-mail or other means by our directors, officers or employees. No additional compensation will be paid to these individuals for soliciting. We intend to post this proxy statement and our 20142017 Annual Report on Form 10-K on our website (http:(http://investor.stamps.com/sec.cfm)sec.cfm) for public review. Except as described above, we do not presently intend to solicit proxies other than by mail. We have no present plans to hire special employees or paid solicitors to assistingassist in obtaining proxies, but reserve the option to do so.

/ Nominations

2

PROPOSAL ONE: ELECTION OF DIRECTORS

DIRECTOR

directors.

a director.

| Name | Age | Position |

| Mohan P. | Director | |

| David C. Habiger (3) | 49 | Director |

| G. Bradford | Director | |

| Kenneth T. McBride | Chairman of the Board and Chief Executive Officer | |

| Director | ||

Nominees

3

Lloyd I. Miller, has been one of our directors since 2002. Mr. Miller is an independent investor and has served on numerous corporate boards of publicly traded companies. Mr. Miller currently serves as a director of American Banknote Corporation, a global supplier of secure documents, services and systems. Mr. Miller was also an observer to the board of directors of Crossroads Inc. and served as a non-board nominating committee chairman of Lexington Coal Company. Mr. Miller has also served as a director of the following companies during the past five years: DDI Corp., Gencor Industries, Pharmos Corporation, Ore Pharmaceuticals and Synergy Brands Inc. He was a member of the Chicago Stock Exchange, Chicago Board of Trade, and traded actively on the floor of the Chicago Board of Trade from 1978 to 1992. Mr. Miller received his B.A. from Brown University. Mr. Miller's extensive experience with and knowledge of business management, investment management, accounting, finance, and capital markets, and his experience serving on the boards of directors of other companies are invaluable to our Board’s discussions regarding business strategy, accounting issues, financial issues, cash management, and share repurchase strategies.

Continuing DirectorDirectors Whose Term Expires at the 20162019 Annual Meeting of Stockholders

Continuing Director Whose Term Expires at

Kenneth McBride hasTextura, a cloud based provider of collaboration productivity and payment solutions. From July 2011 until its sale to Cisco Systems in August 2012, Mr. Habiger served as the Chief Executive Officer of NDS Group Ltd., a provider of video software and content security solutions. Previously, Mr. Habiger served as President and Chief Executive Officer of Sonic Solutions, a world leader in digital media tools and software. Mr. Habiger also serves on the boards of directors of the following public companies: Control4 Corp. (Nasdaq: CTRL), where he is the Lead Director; Echo Global Logistics, Inc. (Nasdaq: ECHO), where he sits on the audit and compensation committees; GrubHub Inc. (NYSE: GRUB), where he sits on the audit and compensation committees; and Xperi (Nasdaq: XPER), where he sits on the audit and nominating committees. He is a venture partner at the Pritzker Group and a boardSenior Advisor to Silver Lake. Mr. Habiger received an MBA from the University of Chicago. Mr. Habiger’s extensive experience operating large organizations, including those that are publicly traded, and his knowledge of technology, business, accounting, and finance, as well as his experience serving on the boards of directors of other companies are invaluable to our Board’s discussions regarding business operations, executive compensation, business strategy, and finance.

4

BOARD COMMITTEES AND MEETINGS AND CORPORATE GOVERNANCE

2017.

2017.

2017.

5

members of management. Upon completion of these interviews and other due diligence, our Nominating Committee may recommend to our Board the election or nomination of a candidate.

Participation

received, within the discretion of the Legal Department.

chief executive officer.

6

Code of Ethics

On April 23, 2014, the Board approved new cash compensation levels that became effective beginningBeginning May 1, 2014. Each2017, each of our non-employee directors receives an annual retainer of $30,000, $1,400$45,000, together with $1,500 for each Board meeting attended and $700$800 for each Board committee meeting attended. AdditionalAlso beginning May 1, 2017, additional annual retainers are paid for service on our Audit Committee or Compensation Committee as follows: the chairman of the Audit Committee receives an additional $15,000;$18,000; other members of the Audit Committee receive an additional $5,000;$6,000; the chairman of the Compensation Committee receives an additional $10,000;$13,000; and other members of the Compensation Committee receive an additional $4,000.$5,000. Directors continue to beare reimbursed for all reasonable expenses incurred by them in attending Board and committee meetings.

7

Director Compensation Table

| Name | Fees Earned or Paid in Cash ($) | Option Awards ($)(1)(2) | Total ($) | ||||||

| Mohan Ananda | 51,600 | 62,050 | 113,650 | ||||||

| G. Bradford Jones | 54,800 | 62,050 | 116,850 | ||||||

| Lloyd I. Miller | 57,600 | 62,050 | 119,650 | ||||||

2017:

| Name | Fees Earned or | Option | ||||

| Paid in Cash | Awards | Total | ||||

| ($) | ($)(1)(2) | ($) | ||||

| Mohan Ananda | 71,500 | 251,800 | 323,300 | |||

| David C. Habiger | 62,500 | 251,800 | 314,300 | |||

| G. Bradford Jones | 76,300 | 251,800 | 328,100 | |||

| Theodore R. Samuels, II | 64,300 | 454,350 | 518,650 | |||

| (1) | The amounts in this column represent the aggregate grant date fair value of option awards granted in |

| (2) | As of December 31, |

8

PROPOSAL TWO: ADVISORY VOTE ON EXECUTIVE COMPENSATION

“

outcome of this advisory vote.

9

PROPOSAL THREE: 20142018 AMENDMENT TO STAMPS.COM INC. 2010 EQUITY INCENTIVE PLAN

On September 19, 2014, pursuant

13, 2018. The 20142018 Amendment was adopted by our Board and the subsequent grant of option awards was approved by our compensation committee, respectively, (i) in order to be able to make significant three year refresh grants to our senior management because all options previously granted to our senior management group, including our named executive officers, which have been granted in three-year cycles, had fully vested in the second quarter of 2014, and the Board deemed it appropriate to approve new option grants in the third quarter of 2014 to incentivize executive performance and Company growth and in April 2015 to recognize our management’s extraordinary efforts that enabled us to enter into the Endicia acquisition agreement and the additional efforts necessary to conclude the transaction; (ii) to recognize and provide equity incentives to continue the Company’sour strong growth and performance, as evidenced by a substantial increase in our market capitalization, revenue and adjusted EBITDA, and the acquisitions of ShipStation and ShipWorks, which were completed in June and August 2014, respectively; and (iii)(ii) to continue to have sufficient awards available for grant to our employees, directors and third party service providersother eligible participants, consistent with the factors described in the Compensation Discussion and Analysis provided with this Proxy Statement, prior to the 2014 Amendment only 1,293,034 shares remained available for awards under the 2010 Plan as of August 31, 2014.Statement. Those factors include: the individual’s position and scope of responsibility; the vesting period (and thus, retention value) remaining on the executive’sgrantee’s existing options; the executive’sgrantee’s ability to affect profitability and stockholder value; the individual’sgrantee’s historic and recent job performance; equity compensation for similar positions at comparable companies; and the value of stock options in relation to other elements of total compensation.

The minimum vesting requirement would help ensure that awards provide incentives for participants to contribute to building the company's long-term value, and prohibiting the payment of dividends on awards that remain unvested or subject to restrictions would prevent a situation where a dividend was paid to an award holder with respect to an award that never vests thus avoiding conferring an unintended benefit.

25, 2018.

10

The following paragraphs include additional information to help assess the potential dilutive impact of awards under the 2010 Plan.

As of December 31, 2014, we had outstanding 15,996,948 shares of common stock.

Asshares as of December 31, 2014, excluding grants made under the 2014 Amendment, a total of 1,986,116 shares of our common stock were subject to outstanding awards, all of which were outstanding stock options.1

April 13, 2018.

| As of December 31, 2017 | As of April 13, 2018 | ||||||

| Plan Category | Number of shares of common stock to be issued upon exercise of outstanding options, warrants and rights (a) | Weighted average exercise price of outstanding options, warrants and rights | Number of shares of common stock remaining available for future issuance under the equity compensation plans (excluding shares reflected in column (a)) | Number of shares of common stock to be issued upon exercise of outstanding options, warrants and rights (b) | Weighted average exercise price of outstanding options, warrants and rights | Number of shares of common stock remaining available for future issuance under the equity compensation plans (excluding shares reflected in column (a)) | |

| Equity compensation plans approved by security holders | 2,703,000 | $90.04 | 307,000 | 2,494,000 | $105.28 | 105,000 | |

| ShippingEasy Stock Options(1) | 42,000 | $86.89 | — | 35,000 | $86.89 | — | |

| ShippingEasy Performance Awards(2) | 65,000 | n/a | — | 9,000 | n/a | — | |

| Inducement Stock Options granted February 26, 2018(3) | n/a | n/a | n/a | 60,000 | $201.00 | — | |

| Total(4) | 2,810,000 | 307,000 | 2,598,000 | 105,000 | |||

| (1) | Reflects the Stamps.com 2016 ShippingEasy Equity Inducement Plan which provided for the issuance of an aggregate of 62,000 stock options to purchase Stamps.com common stock on July 1, 2016. As of |

The weighted-average number Nonetheless, at April 13, 2018, option awards under our 1999 Plan remained outstanding which are exercisable to purchase an aggregate of 7,538 shares of our common stock issued and outstanding in each of the last three fiscal years is 16,079,000 shares issued and outstanding in 2012; 15,691,000 shares issued and outstanding in 2013; and 16,011,000 shares issued and outstanding in 2014. The total number of shares of our common stock subject to awards granted under the 2010 Plan over the last three fiscal years are as follows:

In light of the factors described above, ourOur Board believes the number oftwo million two hundred thousand (2,200,000) additional authorized shares being requestedto be made available for grants of awards under the 20142018 Amendment represents reasonable potential equity dilution and provides a significant incentive formanagement with an appropriate equity plan with which to satisfactorily align the incentives of our employees, directors and third party service providersother eligible participants to increase the value of the Companyour company for all stockholders.

1 Stock options granted September 19, 2014, pursuant to the 2014 Amendment are not included in the total number of shares of common stock subject to outstanding stock options as of December 31, 2014; including such shares, the number of shares subject to outstanding awards would be 2,968,783 all of which are outstanding stock options.

2 Stock options granted pursuant to the 2014 Amendment are included in the total number of shares of common stock subject to outstanding stock options as of April 10, 2015; excluding such shares, the number of shares subject to outstanding awards would be 2,033,447.

3 The 2010 Plan, the 2014 Amendment of which is on the ballot for this annual meeting, is the only active plan that can be used for future equity grants. Shares available for grant pursuant to the 2014 Amendment are not included in the total number of shares available for grant as of April 10, 2015; including such shares, the number of shares available would be 956,930.

11

assumptions are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements involve risks and uncertainties that could cause actual outcomes to differ materially from those in the forward-looking statements, including our ability to attract and retain talent, achievement of performance metrics with respect to certain equity-based awards, the extent of option exercise activity, and others, including those described in our Form 10-K for the year ended December 31, 2014.

2017.

As The 2018 Amendment extends the term of September 19, 2014, and excluding the 20142010 Plan, currently scheduled to expire on June 16, 2020, through April 25, 2028. The 2018 Amendment share increase and options granted to our named executive officers and other employees under the 2014 Amendment that are subject to stockholder approvalalso imposes a minimum vesting period of this Proposal 3, described below, approximately 375,416 shares of common stock remained available12 months for grants offuture awards under the 2010 Plan, calculated as follows:

| subject to certain exceptions, and prohibits the payment of dividends relating to awards under the 2010 Plan unless and until such awards become vested or the applicable restrictions lapse. The 2018 Amendment also makes the following additional changes to the 2010 Plan: The prohibition on repricing of stock options and stock appreciation rights has been made more robust; and The provision for applying shares of stock to tax withholding obligations has been revised to conform to current financial accounting rules. | |||

As of April 10, 2015,13, 2018, and excluding the 2014effects of the 2018 Amendment, share increase and certain options granted to our named executive officers and other employees that are subject to stockholder approval of this Proposal 3, described below, approximately 14,597105,128 shares of stock remain available for future grants of awards under the 2010 Plan, calculated as follows:

| Shares authorized for issuance under the 2010 Plan, as of April | 6,800,000 | ||

| Shares issued and/or subject to awards granted under the 2010 Plan, as of April | 6,694,872 | ||

The specific number of stock option awards, made in 2014 by our compensation committee to each our named executive officers and other executives, which are subject to stockholder approval of this Proposal 3, are identified below:

Stock Option Awards Issued Under the 2014 Amendment | |||||||

Name | Position | September 19, 2014 | April 9, 2015 | ||||

| Kenneth McBride | Chairman and Chief Executive Officer | 166,667 | 50,000 | ||||

| Kyle Huebner | Chief Financial Officer and Co-President | 100,000 | 25,000 | ||||

| James Bortnak | Co-President and Corporate & Business Development Officer | 100,000 | 20,000 | ||||

| John Clem | Chief Product & Strategy Officer | 80,000 | 20,000 | ||||

| Seth Weisberg | Chief Legal Officer and Secretary | 80,000 | 20,000 | ||||

| Sebastian Buerba | Chief Marketing Officer | 96,667 | 20,000 | ||||

| Other Executives | 113,333 | 20,000 | |||||

| Total | 736,667 | 175,000 | |||||

No portion of the foregoing option grants under the 2014 Amendment, all of which are subject to stockholder approval of this Proposal 3, is exercisable until such stockholder approval has been obtained. If stockholder approval of the 2014 Amendment is not obtained by September 9, 2015, the 2014 Amendment and the options granted thereunder will be cancelled.

4 Of the 2,100,000 shares, 982,667 were granted on September 19, 2015 and 175,000 were granted on April 9, 2015, resulting in 942,333 available shares under the 2014 Amendment, and an additional 14,597 shares remain available for grants under the 2010 Plan apart from the 2014 Amendment.

12

Summary of the 2010 Equity Incentive Plan

obtained in advance.

April 25, 2028.

Administration.

Eligibility.

13

Restricted Stock and Restricted Stock Units. A restricted stock award is an award entitlingto the participant to receiveof shares of our stock, which may be subject to restrictions on sale or transfer and/or recoverable by us if specified conditions are not met. A restricted stock unit is an award entitling the participant to receive shares or the cash equivalent of shares at a future date, subject to restrictions. In either case, the lapse of these restrictions may be based on continuing employment (or other business relationship) with us and our subsidiaries and/or achievement of performance goals. At the time of grant, the committeeCompensation Committee will determine such matters as: (a) the number of shares subject to the award; (b) the purchase price or consideration (if any) for the shares; (c) the restrictions placed on the shares; (d) the date(s) when the restrictions placed on the shares will lapse or the performance period during which the achievement of the performance goals will be measured; and (e) in the case of restricted stock units, whether the award will be paid in shares or the cash equivalent of the value of shares. During the period that the restrictions are in place, a participant granted restricted stock will have the rights of a stockholder, including voting and dividend rights (with payment subject to vesting of the shares), but not the right to sell or transfer the shares, and subject to the obligation to return the share under specified circumstances. A participant granted restricted stock units does not have stockholder rights until shares are issued, if at all.

Qualified

Liquidation.exercisable, and shall remain exercisable for a period of fifteen (15) days from the date of notice from the Compensation Committee to the participant of such acceleration of vesting, and the award shall terminate at the end of such period.

14

Incentive Stock Options. No taxable income is recognized when an incentive stock option is granted or exercised (except for purposes of the alternative minimum tax). If the participant exercises an incentive stock option and then later sells or otherwise disposes of the shares more than two years after the grant date and more than one year after the exercise date, the difference between the sale price and the exercise price will be taxed as capital gain or loss. If the participant exercises the incentive stock option and then later sells or otherwise disposes of the shares before the end of the two- or one-year holding periods described above, he or she generally will have ordinary income at the time of the sale equal to the fair market value of the shares on the exercise date (or the sale price, if less) minus the exercise price of the option. Any additional gain or any loss will be capital gain or loss.

granted on or before November 2, 2017, and not modified thereafter.

A copy of the complete text of the 2010 Plan, the 2014 Amendment and the 2016 Amendment are attached hereto as Annex D. A copy of the 2018 Amendment to the 2010 Plan is included as Annex E to this Proxy Statement.

15

Vote Required

Abstentions will be counted towards the tabulation of votes cast and will have the same effect as negative votes, whereas broker non-votes, if any, will not be counted for purposes of determining whether the proposal has been approved.

16

PROPOSAL FOUR: RATIFICATION OF INDEPENDENT AUDITORS

2018.

2018.

2016

Audit-Related Fees

Audit-related fees related to accounting consultations2016, respectively, including for 2017, the services of Ernst & Young LLP in connection with acquisitions totaled approximately $6,504 in 2014. the filing of a Form S-8 Registration Statement.

billed to us during 2017 or 2016.

certain federal tax matters.

17

Pre-Approval Policy

The

18

MANAGEMENT

The following table sets forth certain information regarding our executive officers as of April 15, 2015:

| Name | Age | Position | ||||

| Ken McBride | 50 | Chief Executive Officer and Chairman of the Board of Directors | ||||

| 44 | Chief Financial Officer | |||||

| President | ||||||

| Jonathan Bourgoine | 47 | Chief Technology Officer | ||||

| Sebastian Buerba | 43 | Chief Marketing Officer | ||||

| John Clem | 46 | Chief Product & Strategy Officer | ||||

| 53 | Chief Strategy Officer | |||||

| Matt Lipson | 45 | Chief Legal Officer and Secretary | ||||

| Steve Rifai | 50 | Chief Sales Officer | ||||

Stockholders."

James Bortnak was elected

Sebastian Buerba has been our Chief Marketing Officerchief marketing officer since January 2012. Previously, Mr. Buerba served as Vice President, Marketingour vice president, marketing from April 2009 to January 2012, as Director, Marketingdirector, marketing from April 2006 to April 2009, and as Product Strategy Managerproduct strategy manager from July 2004 to April 2006. Prior to joining Stamps.com, Mr. Buerba worked as Marketing Product Managermarketing product manager for Telecom Argentina Stet-France Telecom S.A. from 1998 to 2002. Mr. Buerba holds a bachelor’s degree, with honors, in Electrical Engineering and a master’s degree in Telecommunications from Instituto Tecnologico de Buenos Aires. Mr. Buerba also holds an MBA, with honors, from The Anderson School of Management, University of California, Los Angeles.

Seth Weisberg

19

EXECUTIVE COMPENSATION

The Company believesup 31% to $208.2 million, non-GAAP adjusted EBITDA was up 32% to $229.9 million, and non-GAAP adjusted income per fully diluted share up 30% to $11.33.

executive management. This encourages our executive management team to focus on managing our company for long term results.

20

On January 28, 2015,April 19, 2017, the Compensation Committee approved the final incentive compensation for 2014, and2016, established the base salaries for 2015,2017, and subsequently on April 9, 2015 the Compensation Committee approvedestablished an incentive compensation plan for 2015, and subsequently on April 21, 2015 the chief executive officer and chief financial officer approved the base salaries and bonuses for executive managers who are not also corporate officers2017 (all decisions collectively, the “2015“2017 Compensation Decisions”). In doing so, the Compensation Committee and the chief executive officer and chief financial officer utilized reports and data from Equilar, Inc. (“Equilar”), a company that provides standardized data based on U.S. proxy data from all publicly traded companies. Equilar.

Base Salary. We pay a base salary to each member of our executive management (each, an “executive manager”) in order to allow the executive manager to cover his living expenses and in order to compete with other employers. We generally establish base salaries for each individual on an annual basis based on (i) the responsibilities of the individual’s position, (ii) the individual’s salary history, performance and perceived ability to influence our financial performance in the short and long-term, (iii) the compensation of our other employees, and (iv) an evaluation of salaries for similar positions in our benchmark group and other competitive factors. We generally seek to set individual base salaries within a reasonable range versus comparable individuals in our benchmark group, taking into account factors such as individual performance and seniority, and taking into account the performance of our company relative to comparable companies under the 2018 Equilar Benchmarks. 2017 Base Salaries For 2017, each corporate officer at the time of the April 19, 2017 Compensation Committee action had his base salary |

For 2015, each corporate officer’s base salary was set by the Compensation Committee between the 3150th and 81st and 98th percentile versus the 20152017 Equilar Benchmarks. In particular, the salaries for our chief executive officer, and our chief financial officer and co-president at such time (now, our president), for 20152017 were set at approximately the 8355rdth percentile and 9364rdth percentile, percentiles, respectively, versus the 20152017 Equilar Benchmarks. In addition, the salaries for our co-president and corporate & business developmentchief product officer, chief product & strategymarketing officer and chief legaltechnology officer (now our former chief technology officer) were set at the 46th, 78th and 76th percentiles, respectively, versus the 2017 Equilar Benchmarks.

21

The Compensation Committee believes that the range of base salaries it set is reasonable. In setting the 20152018 base salaries of executive management, the Compensation Committee noted that when examining the 59175 companies that constitute the complete list of all companies across all titles in the 20152018 Equilar Benchmarks for all of our executives, Stamps.com ranks very highly in several key financial ratios, including the 9276ndth percentile for total net income, and the 9792thnd percentile for return on revenue,equity, the 92nd percentile for return on assets, and the 96th percentile for return on equity.

revenue.

Name and Principal Position | 2015 Base Salary | Percent Increase from 2014 Base Salary | 2015 Base Salary Percentile Versus 2015 Equilar Benchmark | ||||||

| Kenneth McBride | $ | 595,833 | 12 | % | 83 | % | |||

| Chief Executive Officer and Chairman of the Board of Directors | |||||||||

| Kyle Huebner | $ | 364,583 | 6 | % | 93 | % | |||

| Chief Financial Officer and Co-President | |||||||||

| James Bortnak | $ | 333,125 | 5 | % | 98 | % | |||

| Co-President and Corporate & Business Development Officer | |||||||||

| Sebastian Buerba | $ | 285,228 | 10 | % | 62 | % | |||

| Chief Marketing Officer | |||||||||

| John Clem | $ | 287,083 | 9 | % | 64 | % | |||

| Chief Product & Strategy Officer | |||||||||

| Seth Weisberg | $ | 320,000 | 7 | % | 88 | % | |||

| Chief Legal Officer and Secretary | |||||||||

2018.

Name and Principal Position | 2018 Base Salary | Percent Increase from 2017 Base Salary | 2018 Base Salary Percentile Versus 2018 Equilar Benchmark | |||

| Ken McBride | $805,255 | 10% | 68th percentile | |||

| Chief Executive Officer and Chairman of the Board of Directors | ||||||

| Jeff Carberry | $355,000 | 44% | 25th percentile | |||

| Chief Financial Officer | ||||||

| Kyle Huebner | $489,143 | 10% | 50th percentile | |||

| President (CFO until July 31, 2017) | ||||||

| Sebastian Buerba | $424,585 | 10% | 79th percentile | |||

| Chief Marketing Officer | ||||||

| John Clem | $423,258 | 10% | 75th percentile | |||

| Chief Product Officer | ||||||

| Michael Biswas | $419,362 | 5% | 72nd percentile | |||

| Chief Technology Officer | ||||||

22

$1,400,000, $3.25 million, so that, if executive management performedperforms at a reasonable level and is able to generate results at the midpoint of the guidance range, as a group they would receive a total cash compensation for 20142017 slightly above the median level (at the 5767th percentile) versusof those companies in the 20142017 Equilar Benchmarks. Benchmark.

the 2017 Compensation Decisions were made – that is the guidance issued by us on February 23, 2017, when we stated that we expected 2017

Furthermore, in setting the final 2014 pool level, the Compensation Committee noted that when examining the 59 companies that constitute the complete list of all companies across all titles in the 2015 Equilar Benchmarks for all of our executives, Stamps.com ranks very highly in several key financial ratios, including the 92nd percentile for total net income, and the 97th percentile for return on revenue, return on assets and return on equity. Based on this and other criteria, the Compensation Committee considered a 75th percentile ranking for the total compensation of our executive management team, and an approximately 78th percentile ranking for the total compensation of our six named executive officers to be very reasonable.

Once the Compensation Committee established the final 2014 Plan bonus pool level, the Compensation Committee discussed allocation of the bonus pool for the individual executive managers. In doing so, the Compensation Committee discussed individual performance of the executive managers, the performance of Mr. McBride in his overall leadership of our company, and the overall company performance. The Compensation Committee believed thatMr. McBride and the executive management performed very successfully in 2014. Executive managementteam generated very positive 20142017 financial results including: (i) total revenue of $147.3M,$468.7 million, up 15%29% versus 2013;2016; (ii) core mailing & shipping revenue of $139.7M up 16% versus 2013; (iii) pro-forma operating income of $41.0M up 6% versus 2013; (iv)non-GAAP adjusted EBITDA of $44.2M$229.9 million, up 8%32% versus 2013; (v) pro-forma2016; (iii) non-GAAP net income from operations of $40.5M$224.4 million up 4%32% versus 2013; (vi) pro-forma EPS2016; and (iv) non-GAAP adjusted income per fully diluted share of $2.47$11.33 up 3%30% versus 2013; (vii) paid customers growth from 468K2016. After considering the company and individual executive management performance, the Compensation Committee decided to 514K during 2014; and (viii) total postage printed growthset the aggregate final 2017 Plan bonuses at the amount yielded by the formula included in the 2017 Plan, or $5.63 million, an increase of 7% to $1.7 billion. Please see our prior filings on Form 8-K73.3% over the 2017 Base Pool.

23

Based on these factors and an assessment that each of the named executive officers had satisfied theirhis individual goals and objectives, the Compensation Committee set the individual allocation of the 20142017 bonus pool. Additionally, on April 21, 2015 the chief executive officer and the chief financial officer set the compensation of our chief marketing officer as he is not currently a corporate officer; in doing so they considered all of the same aforementioned factors that the Compensation Committee considered, and also evaluated the performance of our chief marketing officer, and also compared his total 2014 compensation to the 2015 Equilar Benchmarks which were calculated in the aforementioned manner. The Compensation Committee was informed of the compensation of the chief marketing officer. The compensation was as follows:

Name and Principal Position | 2014 Non- Equity Incentive Plan (Paid in April 2015) | Fiscal 2014 Bonus (Paid in April 2015) | 2014 Total Base Salary plus 2014 Non-Equity Incentive Plan plus 2014 Bonus Compensation | 2014 Total Base Salary plus Non- Equity Incentive Plan Compensation Plus Bonus Versus 2015 Equilar Benchmarks | ||||||||

| Kenneth McBride | $ | 590,458 | $ | 59,542 | $ | 1,182,667 | 85 | % | ||||

| Chief Executive Officer and Chairman of the Board of Directors | ||||||||||||

| Kyle Huebner | $ | 299,771 | $ | 30,229 | $ | 672,667 | 96 | % | ||||

| Chief Financial Officer and Co-president | ||||||||||||

| James Bortnak | $ | 313,397 | $ | 31,603 | $ | 661,167 | 72 | % | ||||

| Co-President and Corporate & Business Development Officer | ||||||||||||

| Sebastian Buerba | $ | 0 | $ | 241,779 | $ | 500,000 | 72 | % | ||||

| Chief Marketing Officer | ||||||||||||

| John Clem | $ | 188,038 | $ | 18,962 | $ | 470,000 | 67 | % | ||||

| Chief Product & Strategy Officer | ||||||||||||

| Seth Weisberg | $ | 168,053 | $ | 16,947 | $ | 482,833 | 57 | % | ||||

| Chief Legal Officer and Secretary | ||||||||||||

| Name and Principal Position | 2017 Non-Equity Incentive Plan (To Be Paid in May 2018) | 2017 Bonus Compensation (1) | 2017 Total Base Salary plus 2017 Non-Equity Incentive Plan plus 2017 Bonus Compensation | 2017 Total Base Salary plus Non-Equity Incentive Plan Compensation Plus 2017 Bonus Compensation Versus 2018 Equilar Benchmarks | ||||||||||

| Ken McBride | $ | 1,800,000 | — | $ | 2,520,020 | 93rd percentile | ||||||||

| Chief Executive Officer and Chairman of the Board of Directors | ||||||||||||||

| Kyle Huebner | $ | 845,000 | — | $ | 1,282,368 | 68th percentile | ||||||||

| President | ||||||||||||||

| Jeff Carberry (1) | — | 400,000 | $ | 640,609 | 45th percentile | |||||||||

| Chief Financial Officer | ||||||||||||||

| Michael Biswas | $ | 550,000 | — | $ | 942,735 | 97th percentile | ||||||||

| Chief Technology Officer | ||||||||||||||

| Sebastian Buerba (1) | $ | 628,000 | — | $ | 1,000,431 | 99th percentile | ||||||||

| Chief Marketing Officer | ||||||||||||||

| John Clem | $ | 622,000 | — | $ | 1,000,457 | 93rd percentile | ||||||||

| Chief Product Officer | ||||||||||||||

| All other executive officers eligible to participate in the 2017 Plan | $ | 1,185,000 | $ | 400,000 | $ | 2,304,610 | Not meaningful | |||||||

| Total | $ | 5,630,000 | $ | 400,000 | $ | 9,691,230 | 85th percentile | |||||||

| (1) | Mr. Carberry was not an executive officer at the time the 2017 Plan was established, and did not participate in the 2017 Plan. Mr. Carberry received a discretionary bonuses for 2017 separate from the 2017 Plan. |

24

revenue and market capitalization between the 2015 Compensation Decisions and the 2016 Compensation Decisions, with market capitalization expectations being partially based on an increase of market capitalization which has already occurred as of the current date since the 2015 Compensation Decisions were made in January 2015.

The latest publicly available guidance issued by us was on February 12, 2015,21, 2018, when we stated that we expected 20152018 revenue to be in a range of $160$530 million to $180$560 million, and 2015 Non-GAAP net earnings per fully diluted share2018 non-GAAP adjusted EBITDA to be in a range of $2.50$245 million to $2.90.$265 million. The Committee proposed a bonus plan schedule where no increase would be applied to the 2018 Base Pool if the company achieves performance consistent with the mid-point of its public guidance range. The Committee further proposed a 30% decrease be applied to the 2018 Base Pool if the company achieves performance at the low end of its guidance range. The Committee further proposed a 30% increase be applied to the 2018 Base Pool if the company achieves performance at the high end of its guidance range. To illustrate the likely outcomesome possible outcomes of the 20152018 Plan, the following table (i) shows the potential aggregate pool resulting from the formula under the 20152018 Plan if we achieve anthe company achieves a financial outcome at the top end, midpoint, and bottom end of our guidance range and (ii) compares the resulting executive management team total compensation to the total compensation of the 20152018 Equilar benchmarks:

Company Performance vs. Public Guidance (1) | Total Resulting Bonus Pool (1) | Total Executive Team Compensation (2) | Total Team Compensation vs. 2014 Equilar Benchmarks (3) | ||||||

| Bottom End of Guidance Range ($160 million revenue, $2.50 Non-GAAP EPS) | $ | 1,260,000 | $ | 3,737,000 | 53rd percentile | ||||

| Midpoint of Guidance Range ($170 million revenue, $2.70 Non-GAAP EPS) | $ | 1,800,000 | $ | 4,277,000 | 71st percentile | ||||

| Top End of Guidance Range ($180 million revenue, $2.90 Non-GAAP EPS) | $ | 2,340,000 | $ | 4,817,000 | 90th percentile | ||||

| Company Performance vs. Public Guidance (1) | Total Resulting Bonus Pool (1) | Total Executive Team Compensation (2) | Change in Total Executive Team Compensation versus 2017 Total Executive Team Compensation (2) | Total Team Compensation vs. 2018 Equilar Benchmarks (3) | ||||

Bottom End of Guidance Range ($530 million revenue, $245 million Non-GAAP adjusted EBITDA) | $2,870,000 | $6,509,000 | -24% | 58th percentile | ||||

Midpoint of Guidance Range ($545 million revenue, $255 million Non-GAAP adjusted EBITDA) | $4,100,000 | $7,739,000 | -10% | 74th percentile | ||||

Top End of Guidance Range ($560 million revenue, $265 million Non-GAAP adjusted EBITDA) | $5,330,000 | $8,969,000 | -4% | 84th percentile | ||||

| (1) | The Compensation Committee retains the right to change the actual bonus pool in its discretion. |

| (2) | Total executive management team compensation is projected total base salary plus total incentive-based compensation for all current executive managers as a group, including all named executive officers and others. Mr. Bourgoine is expected to receive a bonus under the terms of his separately negotiated employment agreement, and is not expected to participate in the 2018 Bonus Plan. |

| (3) | Total executive management team compensation versus |

25

the vesting period (and thus, retention value) remaining on the executive’s existing options; the executive’s ability to affect profitability and stockholder value; the individual’s historic and recent job performance; equity compensation for similar positions at comparable companies; and the value of stock options in relation to other elements of total compensation.

On September 19, 2014,

The Committee then examined the specific equity practices in these 21 comparable companies. In order to adjust for the common practice of issuing full value awards (e.g., restricted stock) in conjunction with stock options, the Committee used the actual ratio of valuation of a stock option versus the full value share, as reported by each company in its SEC filings under ASC 718. Based on the benchmarks, it was determinedbelief that the median equity award per year forinterests of stockholders will be best served if the 21 comparable companies was 4.6%interests of total shares in addition to equity awards outstanding.

The Committee then examined historical Company grant data. It was noted that over the period of time between 2009 through 2013, we issued ordinary course options to new hires and for promotions of employees other thanour executive management (i.e., not includingare aligned with them, and providing change in control benefits is designed to eliminate, or at least reduce, any one-time company-wide grants). These ordinary course option grants were approximately 1.0% of total shares and grants outstanding each year for the Company. This amount was then subtracted from the total 4.6% annual equity award amount made at the comparable companies to determine the appropriate size of a company-wide grant which, including both the company-wide grant amount plus the annual ordinary course options, would result in the same total number of shares granted as the 21 comparable companies. Based on this analysis, the Committee decided that a company-wide grant of 2 million stock option awards, or approximately 10.5% of the pro-forma outstanding shares plus options following the grant, would be allocated to the 2014 company-wide grant and would vest equally over a period of 36 months.

The Committee next discussed stock option grants for certain of our corporate officers and executive management members, including the named executive officers. The Committee examined current individual employee stock options and stock ownership levels. Based on data available from Equilar, the Committee created a benchmark group for each memberreluctance of executive management to pursue potential change in control transactions that may be in the (“2014 Equity Benchmarks”), made upbest interests of individuals with similar titles and responsibilities at companies (i) with $100stockholders, but potentially adverse to $250 million in revenue; (ii) having market capitalization of $400 million or more; (iii) located in higher cost-of living states (including, CA, CT, DE, FL, GA, IL, MD, MA, MN, NH, NY, PA, TX, VA, WA, DC); and (iv) in industries that include all technology companies. Individuals at other companies who were founders, who were interim, who had resigned, or that had received no equity as of the date of the proxy were excluded from the analysis. Only proxies filed after January 1, 2013 were included.

For eachmanagement’s employment interests. The cash components of our corporate and executive officers, the Committee considered current ownership percentages and pro-forma potential ownership under a new grant, relative to benchmarks of similar executive officers in the other similar companies. The Committee also reviewed and discussed the individual performance of each member of executive management post-termination compensation arrangements, for executives who have any, are up to six months of base salary, and typically also include continuing health benefits during the past several years, and considered future impact that each individual may have on us. The Committee decided to allocate 1,105,000 stock options of the 2 million company-wide grant to our corporate officers and executive management.same period. For information concerning the 2014 stock option grants to our named executive officers, see “Grants of Plan-Based Awards.”

In particular, following the September 19, 2014 incentive stock option grants,example, our chief executive officer held stock and options that represented potential ownership of our common stock at a level below the

26

25th percentile, and our chief financial officer and co-president, held stock and options that represented potential ownershippresident would each receive six months of our common stock at the 63rd percentile,base salary following his termination without cause or termination following a change in each case versus the 2014 Equity Benchmarks as calculated by the Committee.control. In addition, following the September 19, 2014all unvested options under our stock option grants, our chief technology officerplans, including those held stock and options that represented potential ownershipby executive management, vest on involuntary termination of our common stock at the 81st percentile versus the 2014 Equity Benchmarks as calculated by the Committee. Our chief legal officer’s ownership position was above the 90th percentile versus the 2014 Equity Benchmarks as calculated by the Committee (this is attributable to him holding his stock and options for longer periodsemployment within 18 months following a change of time than is typical of comparable counterparts in other companies). Our co-president corporate and business development did not have enough data amongst the 21 companies to do a meaningful analysis, but we believe that his potential equity positions were consistent with past practices and are reasonable.

control.

27

excess compensation was not affectedlimited by the limitations of Section 162(m). We retain the flexibility to pay compensation which is not deductible for tax purposes because we believe that doing so permits us to take into consideration factors that are consistent with good corporate governance and the best interests of our shareholders.

stockholders.

28

COMPENSATION COMMITTEE REPORT

29

Mohan P. Ananda

Summary Compensation Table

Name and Principal Position | Year | 2014 Base Pay | Bonus(1) | Option Awards(2) | Non-Equity Incentive Plan Compensation (1) | All Other Compensation (3) | Total | ||||||||||||

| Ken McBride | 2014 | $ | 532,667 | $ | 59,542 | $ | 986,663 | $ | 590,458 | $ | 5,200 | $ | 2,174,530 | ||||||

| Chairman of the Board and | 2013 | $ | 443,000 | $ | 118,689 | $ | 0 | $ | 438,311 | $ | 5,100 | $ | 1,005,100 | ||||||

| Chief Executive Officer | 2012 | $ | 425,833 | $ | 26,498 | $ | 0 | $ | 353,502 | $ | 5,000 | $ | 810,833 | ||||||

| Kyle Huebner | 2014 | $ | 342,667 | $ | 30,229 | $ | 592,000 | $ | 299,771 | $ | 5,200 | $ | 1,269,867 | ||||||

| Chief Financial Officer and | 2013 | $ | 304,000 | $ | 63,074 | $ | 0 | $ | 232,926 | $ | 5,100 | $ | 605,100 | ||||||

| Co-President | 2012 | $ | 292,500 | $ | 13,249 | $ | 0 | $ | 176,751 | $ | 5,000 | $ | 487,500 | ||||||

| James Bortnak | 2014 | $ | 316,167 | $ | 31,603 | $ | 592,000 | $ | 313,397 | $ | 5,182 | $ | 1,258,349 | ||||||

| Co-President and Corp. | 2013 | $ | 270,667 | $ | 70,176 | $ | 0 | $ | 259,157 | $ | 5,100 | $ | 605,100 | ||||||

| & Bus. Dev. Officer | 2012 | $ | 262,667 | $ | 11,506 | $ | 0 | $ | 153,494 | $ | 5,000 | $ | 432,667 | ||||||

| Sebastian Buerba | 2014 | $ | 258,221 | $ | 241,779 | $ | 572,263 | $ | 0 | $ | 5,200 | $ | 1,077,463 | ||||||

| Chief Marketing Officer | 2013 | $ | 235,175 | $ | 195,000 | $ | 0 | $ | 0 | $ | 5,100 | $ | 435,275 | ||||||

| 2012 | $ | 227,500 | $ | 120,000 | $ | 0 | $ | 0 | $ | 5,000 | $ | 352,500 | |||||||

| Seth Weisberg | 2014 | $ | 297,833 | $ | 16,947 | $ | 473,600 | $ | 168,053 | $ | 5,200 | $ | 961,633 | ||||||

| Chief Legal Officer and | 2013 | $ | 285,500 | $ | 33,028 | $ | 0 | $ | 121,972 | $ | 5,100 | $ | 445,600 | ||||||

| Secretary | 2012 | $ | 276,667 | $ | 8,786 | $ | 0 | $ | 117,214 | $ | 5,000 | $ | 407,667 | ||||||

| John Clem | 2014 | $ | 263,000 | $ | 18,962 | $ | 473,600 | $ | 188,038 | $ | 5,009 | $ | 948,609 | ||||||

| Chief Product & | 2013 | $ | 251,667 | $ | 38,356 | $ | 0 | $ | 141,644 | $ | 7,007 | $ | 438,674 | ||||||

| Strategy Officer | 2012 | $ | 243,333 | $ | 9,693 | $ | 0 | $ | 129,307 | $ | 4,685 | $ | 387,018 | ||||||

”

| Name and Principal Position | Year | Base Pay | Bonus (1)(2) | Non-Equity Incentive Plan Compensation (2) | Option Awards (3)(4) | All Other Compensation (5) | Total(4) | |||||||

| Ken McBride | 2017 | $720,020 | $0 | $1,800,000 | 5,601,350 | $5,400 | $8,126,770 | |||||||

| Chairman of the Board and | 2016 | $654,796 | $0 | $1,620,000 | $0 | $5,300 | $2,280,096 | |||||||

| Chief Executive Officer | 2015 | $595,833 | $100,000 | $1,033,000 | $8,371,014 | $5,300 | $10,105,147 | |||||||

| Jeff Carberry | 2017 | $240,609 | $400,000 | $0 | $3,171,228 | $3,567 | $3,815,404 | |||||||

| Chief Financial Officer (6) | 2016 | $218,735 | $285,000 | $0 | $0 | $4,202 | $507,937 | |||||||

| 2015 | $208,664 | $190,000 | $0 | $1,915,614 | $4,173 | $2,318,451 | ||||||||

| Kyle Huebner | 2017 | $437,368 | $0 | $845,000 | $3,380,125 | $5,400 | $4,667,893 | |||||||

| President (7) | 2016 | $397,748 | $0 | $794,000 | $0 | $5,300 | $1,197,048 | |||||||

| 2015 | $364,583 | $50,000 | $520,000 | $4,896,500 | $5,300 | $5,836,383 | ||||||||

| Michael Biswas | 2017 | $392,735 | $0 | $550,000 | $2,704,100 | $5,400 | $3,652,235 | |||||||

| Chief Technology Officer | 2016 | $354,921 | $0 | $535,000 | $0 | $5,300 | $895,221 | |||||||

| 2015 | $323,422 | 20,000 | $375,000 | $3,917,200 | $5,300 | $4,640,922 | ||||||||

| Sebastian Buerba | 2017 | $372,431 | $0 | $628,000 | $2,704,100 | $5,195 | $3,709,726 | |||||||

| Chief Marketing Officer (8) | 2016 | $323,854 | $565,000 | $0 | $0 | $5,186 | $894,040 | |||||||

| 2015 | $294,923 | $420,000 | $0 | $4,628,214 | $5,300 | $5,348,437 | ||||||||

| John Clem | 2017 | $378,457 | $0 | $622,000 | $2,704,100 | $5,400 | $3,709,957 | |||||||

| Chief Product Officer | 2016 | $339,485 | $0 | $550,000 | $0 | $5,300 | $1,197,048 | |||||||

| 2015 | $287,083 | $20,000 | $400,000 | $3,917,200 | $7,300 | $4,631,583 | ||||||||

| (1) | Bonuses for 2017 paid to corporate officers who were not participants in the 2017 Plan, such as Mr. Carberry, consisted of discretionary bonuses awarded by the Compensation Committee. |

| (2) | Bonuses paid to corporate officers and other executive management |

| (3) | The amounts in this column generally represent the aggregate grant date fair value of option awards granted during |

| (4) | Due to the increase in our stock price between the date of grant and the date of stockholder approval, the Contingent Grants were valued at $42.66 per share, as compared to the $11.84 per share valuation for the other options granted on the same date. As a result, the Contingent Grants to Messrs. McBride, Carberry, Huebner, Biswas, Buerba and Clem accounted for $7,110,014, $1,564,214, $4,266,000, $3,412,800, $4,123,814 and $3,412,800, respectively, of their option award amounts in 2015. In the aggregate, the Contingent Grants resulted in stock-based compensation expense of up to approximately $41.9 million, including the $23.9 million attributable to our named executive officers. |

| (5) | Consists of contributions to our 401(k) plan that we made on behalf of |

| (6) | Mr. Carberry was appointed as our chief financial officer on July 31, 2017. Prior to that, he served as our vice president, finance and was not an executive officer of the company. The table reflects Mr. Carberry’s total compensation from us for each of 2015, 2016 and 2017, in all capacities. |

| (7) | Mr. Huebner was appointed as our president on July 31, 2017. Prior to that, he served as our chief financial officer and co-president. The table reflects Mr. Huebner’s total compensation from us for each of 2015, 2016 and 2017, in all capacities. |

| (8) | Although Mr. Buerba has been our chief marketing officer since January 2012, he was not an executive officer of the company until he began reporting directly to our chief executive officer on July 31, 2017. The table reflects Mr. Buerba’s total compensation from us for each of 2015, 2016 and 2017, in all capacities. |

30

As it has been our general practice to grant awards of stock options to our executive management team every three years, we expect that, historically, our CEO pay ratio would be significantly higher in years when our chief executive officer receives such grants and lower in the two intervening years (although, pursuant to the

Name | Grant Date | Estimated Future Payouts Under Non-Equity Incentive Plan Awards (1) | All Other Option Awards: Number of Securities Underlying Option (#)(5) | Exercise or Base Price of Option Awards ($/Sh) | Grant Date Fair Value of Stock and Option Awards(6) | ||||||||||||||||

Threshold ($)(2) | Target ($)(3) | Maximum ($)(4) | |||||||||||||||||||

| Ken McBride | 4/2/2014 | $ | 312,396 | $ | 446,280 | $ | 892,560 | ||||||||||||||

83,333(5 | ) | $ | 32.41 | $ | 986,663 | ||||||||||||||||

| 9/19/2014 | 166,667(7 | ) | $ | 32.41 | — | ||||||||||||||||

| Kyle Huebner | 4/2/2014 | $ | 166,013 | $ | 237,161 | $ | 474,323 | ||||||||||||||

50,000(5 | ) | $ | 32.41 | $ | 592,000 | ||||||||||||||||

| 9/19/2014 | 100,000(7 | ) | $ | 32.41 | — | ||||||||||||||||

| James Bortnak | 4/2/2014 | $ | 184,708 | $ | 263,869 | $ | 527,737 | ||||||||||||||

50,000(5 | ) | $ | 32.41 | $ | 592,000 | ||||||||||||||||

| 9/19/2014 | 100,000(7 | ) | $ | 32.41 | — | ||||||||||||||||

| John Clem | 4/2/2014 | $ | 100,954 | $ | 144,220 | $ | 288,440 | ||||||||||||||

40,000(5 | ) | $ | 32.41 | $ | 473,600 | ||||||||||||||||

| 9/19/2014 | 80,000(7 | ) | $ | 32.41 | — | ||||||||||||||||

| Seth Weisberg | 4/2/2014 | $ | 86,932 | $ | 124,189 | $ | 248,379 | ||||||||||||||

40,000(5 | ) | $ | 32.41 | $ | 473,600 | ||||||||||||||||

| 9/19/2014 | 80,000(7 | ) | $ | 32.41 | — | ||||||||||||||||

Estimated Possible Payouts Under Non-Equity Incentive Plan Awards (1)(2) | Option Awards: Number of Securities Underlying Option (#)(7) | Exercise or Base Price of Option Awards ($/Sh) | Grant Date Fair Value of Stock and Option Awards(8) | |||||||||||||

| Name | Grant Date (3) | Threshold ($)(4) | Target ($)(5) | Maximum ($)(6) | ||||||||||||

| Ken McBride | 4/19/2017 | $801,196 | $1,144,565 | $2,289,130 | 145,000 | $112.00 | $ | 5,601,350 | ||||||||

| Kyle Huebner | 4/19/2017 | $392,685 | $560,978 | $1,121,957 | 87,500 | $112.00 | $ | 3,380,125 | ||||||||

| Jeff Carberry | 8/1/2017 | n/a | n/a | n/a | 60,000 | $152.15 | $ | 3,171,228 | ||||||||

| Michael Biswas | 4/19/2017 | $264,592 | $377,989 | $755,978 | 70,000 | $112.00 | $ | 2,704,100 | ||||||||

| Sebastian Buerba | 4/25/2017 | n/a | n/a | n/a | 70,000 | $112.00 | $ | 2,704,100 | ||||||||

| John Clem | 4/19/2017 | $272,011 | $388,587 | $777,174 | 70,000 | $112.00 | $ | 2,704,100 | ||||||||

| (1) | Under the |

| (2) | Mr. Carberry, who did not become an executive officer until July 31, 2017, did not participate in the 2017 Plan. |

| (3) | Each of Messrs. McBride, Huebner, Biswas, Buerba and Clem was eligible for an award under the 2017 Plan, which was established on April 19, 2017, and was also granted an award of stock options on April 25, 2017. |

| (4) | The amounts in this column assume (i) an aggregate bonus pool equal to 70% of the |

31

$125 million in total revenue and $2.10 in non-GAAP pro-forma net income per share; and (ii) that each named executive officer received the same percentage share of the bonus pool that he received under the 2013 bonus plan. However, no individual named executive officer is guaranteed any minimum amount, so the amount could in fact be zero.

| (5) | The amounts in this column assume (i) an aggregate bonus pool equal to 100% of the 2017 Base Pool, which would have resulted from an actual 2017 financial outcome at the mid-point of our February 2017 public guidance range of $412.5 million in total revenue and $210 million in non-GAAP adjusted EBITDA (note that our public guidance range was subsequently changed at various times throughout fiscal 2017); and (ii) that each named executive officer received the same percentage share of the bonus pool that he received under the 2016 bonus plan. However, no individual named executive officer |

| (6) | The amounts in this column assume the maximum possible bonus pool of 200% of the |

| (7) | These option awards were all issued under the 2010 |

| (8) | The amounts in this column represent the aggregate grant date fair value of option awards granted during |

32

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

Option Awards | ||||||||||||

Number of Securities Underlying Unexercised Options (#) Exercisable (1) | Number of Securities Underlying Unexercised Options (#) Unexercisable (1) | Option Exercise Price ($) | Option Expiration Date | |||||||||

| Name | ||||||||||||

| Kenneth McBride | 27,779 | — | 12.55 | 5/20/2021 | ||||||||

20,833 | 62,500(1 | ) | 32.41 | 9/19/2024 | ||||||||

— | 166,667(2 | ) | 32.41 | 9/19/2024 | ||||||||

| Kyle Huebner | 24,306 | — | 12.55 | 5/20/2021 | ||||||||

12,499 | 37,501(1 | ) | 32.41 | 9/19/2024 | ||||||||

— | 100,000(2 | ) | 32.41 | 9/19/2024 | ||||||||

| James Bortnak | 12,499 | 37,501(1 | ) | 32.41 | 9/19/2024 | |||||||

— | 100,000(2 | ) | 32.41 | 9/19/2024 | ||||||||

| Sebastian Buerba | — | — | — | — | ||||||||

12,083 | 36,250(1 | ) | 32.41 | 9/19/2024 | ||||||||

— | 96,667(2 | ) | 32.41 | 9/19/2024 | ||||||||

| John Clem | 16,667 | — | 12.55 | 5/20/2021 | ||||||||

9,999 | 30,001(1 | ) | 32.41 | 9/19/2024 | ||||||||

— | 80,000(2 | ) | 32.41 | 9/19/2024 | ||||||||

| Seth Weisberg | 20,837 | — | 13.10 | 5/21/2017 | ||||||||

100,000 | — | 12.55 | 5/20/2021 | |||||||||

9,999 | 30,001(1 | ) | 32.41 | 9/19/2024 | ||||||||

— | 80,000(2 | ) | 32.41 | 9/19/2024 | ||||||||

2017:

| Option Awards | ||||||||||

| Name | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercisable Options (#) | Option Exercise Price ($) | Option Expiration Date | ||||||

| Ken McBride | 40,337 (1) | — | 32.41 | 9/19/2024 | ||||||

| 34,721 (2) | 15,278 (2) | 66.28 | 4/9/2025 | |||||||

| 12,082 (3) | 132,918 (3) | 112.00 | 4/25/2027 | |||||||

| Kyle Huebner | 29,268 (1) | — | 32.41 | 9/19/2024 | ||||||

| 6,944 (2) | 7,640 (2) | 66.28 | 4/9/2025 | |||||||

| 7,291 (3) | 80,209 (3) | 112.00 | 4/25/2027 | |||||||

| Jeff Carberry | 9,444 (4) | 556 (4) | 45.35 | 2/2/2025 | ||||||

| 9,166 (5) | 834 (5) | 58.25 | 3/2/2025 | |||||||

| 6,666 (6) | 53,334 (6) | 152.15 | 8/1/2027 | |||||||

| Michael Biswas | 5,976 | — | 12.55 | 5/20/2021 | ||||||

| 3,346 (1) | — | 32.41 | 9/19/2024 | |||||||

| 2,222 (2) | 6,112 (2) | 66.28 | 4/9/2025 | |||||||

| 5,833 (3) | 64,167 (3) | 112.00 | 4/25/2027 | |||||||

| Sebastian Buerba | 10,248 (7) | — | 32.41 | 9/19/2024 | ||||||

| 50,497 (1) | — | 32.41 | 9/19/2024 | |||||||

| 13,888 (2) | 6,112 (2) | 66.28 | 4/9/2025 | |||||||

| 5,833 (3) | 64,167 (3) | 112.00 | 4/25/2027 | |||||||

| John Clem | 36,915 (7) | — | 32.41 | 9/19/2024 | ||||||

| 43,830 (1) | — | 32.41 | 9/19/2024 | |||||||

| 13,888 (2) | 6,112 (2) | 66.28 | 4/9/2025 | |||||||

| 5,833 (3) | 64,167 (3) | 112.00 | 4/25/2027 | |||||||

| These option awards issued under the 2014 Amendment |

| (2) | These performance-based option awards issued under the 2014 Amendment vest and become exercisable in equal monthly installments on the last day of each month over the 36 months following the November 18, 2015 close of the Endicia acquisition. The grants will fully vest on November 18, 2018. |

| (3) | These option awards issued under the 2010 Equity Incentive Plan, as amended, vest in 36 approximately equal monthly installments beginning with October 1, 2017. |

| (4) | These option awards issued under the 2010 Equity Incentive Plan, as amended, vested in 36 approximately equal monthly installments beginning on March 2, 2015. |

| (5) | These option awards issued under the 2010 Equity Incentive Plan, as amended, vested in 36 approximately equal monthly installments beginning on April 2, 2015. |

| (6) | These option awards issued under the 2010 Equity Incentive Plan, as amended, vest in 36 approximately equal monthly installments beginning with September 1, 2017. |

| (7) | These option awards issued under the 2010 Equity Incentive Plan, as amended, vested in equal monthly installments over a 12 month period from October 19, 2014 through September 19, |

33

OPTION EXERCISES AND STOCK VESTED

Option Awards | ||||||

Name | Number of Shares Acquired on Exercise (#) | Value Realized on Exercise ($)(1) | ||||

| Ken McBride | 6,944 | 181,990 | ||||

| James Bortnak | 13,889 | 307,919 | ||||

| Seth Weisberg | 35,400 | 1,129,486 | ||||

| Option Awards | |||||||

| Name | Number of Shares Acquired on Exercise (#) | Value Realized on Exercise ($)(1) | |||||

| Ken McBride | 230,248 | $ | 30,210,352 | ||||

| Kyle Huebner | 141,316 | $ | 13,993,785 | ||||

| Jeff Carberry | 59,583 | $ | 11,807,626 | ||||

| Michael Biswas | 141,788 | $ | 24,713,190 | ||||

| Sebastian Buerba | 88,144 | $ | 13,422,473 | ||||

| John Clem | 41,784 | $ | 6,925,530 | ||||

| (1) | Value realized on exercise is based on the fair market value of our common stock on the date of exercise minus the exercise price and does not necessarily reflect proceeds actually received by the named executive officer. |

Name | Payment Upon Termination without Cause or Termination or Resignation Following Change in Control (1) | ||

| Ken McBride | $ | 282,854 | |

| Kyle Huebner | $ | 182,854 | |

| James Bortnak | $ | 170,354 | |

| Seth Weisberg | $ | 157,854 | |

| Name | Payment Upon Termination without Cause or Termination or Resignation Following Change in Control (1) | |||

| Ken McBride | $ | 378,104 | ||

| Kyle Huebner | $ | 234,416 | ||

| (1) | Assumes a monthly value of |

34

Assuming triggering events occurred on December 31, 2014,2017, the following amounts would then be accelerated as a result of the acceleration of stock options for our named executive officers based on a closing stock price of $47.99$188.00 on December 29, 2017.

| Name | Options Accelerated Upon Involuntary Termination following Change in Control (1) | |||

| Ken McBride | $ | 11,961,406 | ||

| Kyle Huebner | $ | 7,025,825 | ||

| Jeff Carberry | $ | 1,992,881 | ||

| Michael Biswas | $ | 5,620,645 | ||

| Sebastian Buerba | $ | 5,620,645 | ||

| John Clem | $ | 5,620,645 | ||

Name | Options Accelerated Upon Involuntary Termination following Change in Control (1) | ||

| Ken McBride | $ | 3,570,422 | |

| Kyle Huebner | $ | 2,142,266 | |

| James Bortnak | $ | 2,142,266 | |

| Sebastian Buerba | $ | 2,070,847 | |

| John Clem | $ | 1,713,816 | |

| Seth Weisberg | $ | 1,713,816 | |

35

BENEFICIAL OWNERSHIP OF SECURITIES

Name of Beneficial Owner | Number of Shares Beneficially Owned | Percentages of Shares Beneficially Owned | ||||

| Kenneth McBride (1) | 89,535 | * | ||||

| Kyle Huebner (2) | 59,385 | * | ||||

| Michael Biswas (3) | 47,056 | * | ||||

| James Bortnak (4) | 21,433 | * | ||||

| John Clem (5) | 46,045 | * | ||||

| JP Leon (6) | 30,721 | * | ||||

| Seth Weisberg (7) | 98,352 | * | ||||

| Mohan P. Ananda (8) | 736,524 | 4.49 | % | |||

| G. Bradford Jones (9) | 94,786 | * | ||||

| Lloyd I. Miller (10) | 880,344 | 5.37 | % | |||

| Other 5% Stockholders: | ||||||

| BlackRock, Inc. (11) | 1,340,072 | 8.19 | % | |||

| 40 East 52nd Street | ||||||

| New York, NY 10022 | ||||||

| FMR LLC (12) | 2,215,894 | 13.55 | % | |||

| 82 Devonshire Street | ||||||

| Boston, Massachusetts 02109 | ||||||

| Conestoga Capital Advisors LLC (13) | 847,897 | 5.18 | % | |||

| 550 E. Swedesford Road, Suite 120 | ||||||

| Wayne, Pennsylvania 19087 | ||||||

| All directors and executive offers as a group (11 people) | 2,104,181 | 12.49 | % | |||

| Name of Beneficial Owner | Number of Shares Beneficially Owned | Percentages of Shares Beneficially Owned | |||

| Ken McBride (1) | 79,943 | * | |||

| Kyle Huebner (2) | 10,417 | * | |||

| Jeff Carberry (3) | 46,242 | * | |||

| Michael Biswas (4) | 10,295 | * | |||

| Sebastian Buerba (5) | 20,441 | * | |||

| John Clem (6) | 118,939 | * | |||

| Mohan P. Ananda (7) | 670,524 | 3.69 | % | ||

| David C. Habiger (8) | 10,000 | * | |||

| G. Bradford Jones (9) | 75,286 | * | |||

| Theodore R. Samuels, II (10) | 11,000 | * | |||

| Other 5% Stockholders: | |||||

| FMR LLC (11) | 2,212,459 | 12.37 | % | ||

| 82 Devonshire Street | |||||

| Boston, Massachusetts 02109 | |||||

| BlackRock, Inc. (12) | 2,016,516 | 11.27 | % | ||

| 40 East 52nd Street | |||||

| New York, NY 10022 | |||||

| The Vanguard Group (13) | 1,547,702 | 8.65 | % | ||

| 100 Vanguard Blvd. | |||||

| Malvern, PA 19355 | |||||

| All directors and executive officers as a group (13 people) (14) | 1,129,007 | 6.17 | % | ||

| * | Represents beneficial ownership of less than 1% of the outstanding shares of common stock. |

| (1) | Includes |

| (2) | Includes |

| (3) | Includes |

36

| (4) | Includes |

| (5) | Includes |

| (6) | Includes |

| (7) | Includes |

| (8) | Includes 10,000 shares |

| (9) | Includes |

| (10) |

| (11) |

| (12) |

| (13) | Information regarding The Vanguard Group’s beneficial ownership is based solely on a Schedule 13G/A it filed with the SEC on February 23, 2018. Various registered investment companies advised by The Vanguard Group, Inc. have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, our common stock, although no single such company’s interest in our common stock is more than five percent of the total outstanding. |

| (14) | Includes an aggregate of 408,128 shares issuable upon exercise of options that are presently exercisable or will become exercisable within 60 days of April 13, 2018. Includes shares beneficially owned by the individuals who are our executive officers as of April 13, 2018, and does not include shares beneficially owned by our former executive officers, including our former chief technology officer, who are no longer serving as executive officers of the company as of April 13, 2018. |

37

AUDIT COMMITTEE REPORT

38

Mohan Ananda

2017.

39

Annual Report

40

| Company Name |

| AMERICAN SOFTWARE INC |

| APPLIED MICRO CIRCUITS CORP |

| BLACK DIAMOND INC |

| CALAMP CORP. |

| CAVIUM INC. |

| COMMUNICATIONS SYSTEMS INC |

| DICE HOLDINGS INC |

| DSP GROUP INC |

| EBIX INC |

| ELECTRO SCIENTIFIC INDUSTRIES INC |

| EXAR CORP |

| HURCO COMPANIES INC |

| ICG GROUP INC |

| INCONTACT INC |

| INNOTRAC CORP |

| KEYNOTE SYSTEMS INC |

| KEYW HOLDING CORP |

| KVH INDUSTRIES INC |

| LIMELIGHT NETWORKS INC |

| LTX-CREDENCE CORP |

| MATTSON TECHNOLOGY INC |

| MINDSPEED TECHNOLOGIES INC |

| MONOLITHIC POWER SYSTEMS INC |

| PARK ELECTROCHEMICAL CORP |

| PLX TECHNOLOGY INC |

| RUDOLPH TECHNOLOGIES INC |

| SEACHANGE INTERNATIONAL INC |

| SIGMA DESIGNS INC |

| SOURCEFIRE INC |

| ULTRATECH INC |

| VASCO DATA SECURITY INTERNATIONAL INC |

| VICOR CORP |

| VITESSE SEMICONDUCTOR CORP |

| VOCUS INC |

| VOLTERRA SEMICONDUCTOR CORP |

| XO GROUP INC |

| ZHONE TECHNOLOGIES INC |

| ZYGO CORP |

| Company Name |

| 8X8 INC /DE/ |

| ATLANTIC TELE NETWORK INC /DE |

| AVG TECHNOLOGIES N.V. |

| BADGER METER INC |

| BROOKS AUTOMATION INC |

| CALLIDUS SOFTWARE INC |

| CUBIC CORP /DE/ |

| CVENT INC |

| DESCARTES SYSTEMS GROUP INC |

| ENGHOUSE SYSTEMS LTD. |

| ESCO TECHNOLOGIES INC |

| EVOLENT HEALTH, INC. |

| FABRINET |

| FIDESSA GROUP PLC |

| GENERAL COMMUNICATION INC |

| GIGAMON INC |

| GTT Communications, Inc. |

| GoPro, Inc. |

| INVENSENSE INC |

| IXIA |

| Interactive Intelligence Group, Inc. |

| KINAXIS INC. |

| KULICKE & SOFFA INDUSTRIES INC |

| METHODE ELECTRONICS INC |

| Marketo, Inc. |

| NETGEAR, INC |

| OCLARO, INC. |

| OMNICELL, Inc |

| OSI SYSTEMS INC |

| POLYCOM INC |

| PREMIER, INC. |

| PROGRESS SOFTWARE CORP /MA |

| Q2 Holdings, Inc. |

| QLOGIC CORP |

| QUALYS, INC. |

| RAMBUS INC |

| RUCKUS WIRELESS INC |

| SUPER MICRO COMPUTER, INC. |

| SYKES ENTERPRISES INC |

| SYNAPTICS INC |

| SYNTEL INC |

| VEECO INSTRUMENTS INC |

| VONAGE HOLDINGS CORP |

41

| 2U, INC. |

| ACI WORLDWIDE, INC. |

| ACXIOM CORP |

| AMBARELLA INC |

| BOX INC |

| BRADY CORP |

| CABOT MICROELECTRONICS CORP |

| CELESTICA INC |

| COMMVAULT SYSTEMS INC |

| CREE INC |

| Cornerstone OnDemand Inc |

| DIEBOLD NIXDORF, INC |

| EBIX INC |

| ELECTRONICS FOR IMAGING INC |

| FAIRCHILD SEMICONDUCTOR INTERNATIONAL INC |

| FRONTIER COMMUNICATIONS CORP |

| Fleetmatics Group plc |

| GENERAC HOLDINGS INC. |

| GameStop Corp. |

| Groupon, Inc. |

| HUBSPOT INC |

| II-VI INC |

| INPHI Corp |

| Inovalon Holdings, Inc. |

| LIFELOCK, INC. |

| MAXLINEAR INC |

| MERCURY SYSTEMS INC |

| MacDonald, Dettwiler and Associates Ltd. |

| Manitoba Telecom Services Inc. |

| NEUSTAR INC |

| PLANTRONICS INC /CA/ |

| PLEXUS CORP |

| RINGCENTRAL INC |

| SEMTECH CORP |

| SOLARCITY CORP |

| VIAVI SOLUTIONS INC. |

| ZYNGA INC |

| ADVANCED ENERGY INDUSTRIES INC |

| CACI INTERNATIONAL INC /DE/ |

| FINISAR CORP |

| FIRST SOLAR, INC. |

| InterDigital, Inc. |

| LEXMARK INTERNATIONAL INC /KY/ |

| REALPAGE INC |

| SANMINA CORP |

| SILICON LABORATORIES INC |

| VERINT SYSTEMS INC |

| YELP INC |

| Company |

| EBIX INC |

| Fleetmatics Group plc |

| II-VI INC |

| KINAXIS INC. |

| 8X8 INC /DE/ |

| ACXIOM CORP |

| AMBARELLA INC |

| ATLANTIC TELE NETWORK INC /DE |

| AVX Corp |

| CALLIDUS SOFTWARE INC |

42

| CSG SYSTEMS INTERNATIONAL INC |

| CUBIC CORP /DE/ |

| DIEBOLD NIXDORF, INC |

| DIODES INC /DEL/ |

| ENDURANCE INTERNATIONAL GROUP HOLDINGS, INC. |

| FITBIT INC |

| FABRINET |

| GameStop Corp. |

| GIGAMON INC |

| GRUBHUB INC. |

| HUBSPOT INC |

| II-VI INC |

| INNOVIVA, INC. |

| ITRON INC /WA/ |

| IXIA |

| InterDigital, Inc. |

| LORAL SPACE & COMMUNICATIONS INC. |

| KINAXIS INC. |

| MANTECH INTERNATIONAL CORP |

| METHODE ELECTRONICS INC |

| Marketo, Inc. |

| MERCURY SYSTEMS INC |

| INSIGHT ENTERPRISES INC |

| NEUSTAR INC |

| NETGEAR, INC |

| NIC INC |

| OCLARO, INC. |

| OMNICELL, Inc |

| OSI SYSTEMS INC |

| PLEXUS CORP |

| POLYCOM INC |

| PREMIER, INC. |

| REALPAGE INC |

| RINGCENTRAL INC |

| ROGERS CORP |

| SANMINA CORP |

| SOLARCITY CORP |

| SEMTECH CORP |

| SYNCHRONOSS TECHNOLOGIES INC |

| SILICON LABORATORIES INC |

| SYKES ENTERPRISES INC |

| SYNAPTICS INC |

| TELEPHONE & DATA SYSTEMS INC /DE/ |

| TIVO CORP |

| TTM TECHNOLOGIES INC |

| 2U, INC. |

| VEECO INSTRUMENTS INC |

| VERINT SYSTEMS INC |

| VISHAY INTERTECHNOLOGY INC |

| VONAGE HOLDINGS CORP |

| WEST CORP |

| WINDSTREAM HOLDINGS, INC. |

| XPERI CORP |

| Company |

| 2U, INC. |

| AVX Corp |

| CALLIDUS SOFTWARE INC |

| FIRST SOLAR, INC. |

| II-VI INC |

INTERNATIONAL INC |

| Company |

| 8X8 INC /DE/ |

| BADGER METER INC |

43

| DESCARTES SYSTEMS GROUP INC |

| FINISAR CORP |

| FABRINET |

| GRUBHUB INC. |

| Inovalon Holdings, Inc. |

| KINAXIS INC. |

| KINAXIS INC. |

| NETGEAR, INC |

| PROGRESS SOFTWARE CORP /MA |

| Q2 Holdings, Inc. |

| QUALYS, INC. |

| SEMTECH CORP |

| SHUTTERFLY INC |

| SYNAPTICS INC |

| ZENDESK, INC. |

| Company |

| ARRIS International plc |

| AVX Corp |

| BADGER METER INC |

| DST SYSTEMS INC |

| ENCORE WIRE CORP |

| ENGHOUSE SYSTEMS LTD. |

| EPLUS INC |

| MENTOR GRAPHICS CORP |

| QUALYS, INC. |

| REALPAGE INC |

| SHENANDOAH TELECOMMUNICATIONS CO/VA/ |

| SYSTEMAX INC |

| WEST CORP |

| Company |

| 2U, |

| 8X8 INC /DE/ |

| AMBARELLA INC |

| ARRIS International plc |

| AVX Corp |

| BADGER METER INC |

| BENCHMARK ELECTRONICS INC |

| BOINGO WIRELESS INC |

| BOTTOMLINE TECHNOLOGIES INC /DE/ |

| BRADY CORP |

| BROOKS AUTOMATION INC |

| COMMVAULT SYSTEMS INC |

| Coupa Software Inc |

| CRITEO S.A. |

| CSG SYSTEMS INTERNATIONAL INC |

| DESCARTES SYSTEMS GROUP INC |

44

| ENCORE WIRE CORP |

| Endurance International Group Holdings, Inc. |

| ENGHOUSE SYSTEMS LTD. |

| EPLUS INC |

| EXTREME NETWORKS INC |

| FIDESSA GROUP PLC |

| FINISAR CORP |

| FORESCOUT TECHNOLOGIES, INC |

| FORMFACTOR INC |

| GameStop Corp. |

| Groupon, Inc. |

| GTT Communications, Inc. |

| HEALTHEQUITY INC |

| HUBSPOT INC |

| II-VI INC |

| INFINERA Corp |

| INNOVIVA, INC. |

| INSIGHT ENTERPRISES INC |

| INSTRUCTURE INC |

| INTEGRATED DEVICE TECHNOLOGY INC |

| InterDigital, Inc. |

| INTERSIL CORP/DE |

| ITRON INC /WA/ |

| J2 GLOBAL, INC. |

| JABIL INC |

| KEMET CORP |

| LORAL SPACE & COMMUNICATIONS INC. |

| MACOM TECHNOLOGY SOLUTIONS HOLDINGS, INC. |

| MANHATTAN ASSOCIATES INC |

| Medidata Solutions, Inc. |

| Mellanox Technologies, Ltd. |

| MERCURY SYSTEMS INC |

| MICROSTRATEGY INC |

| MongoDB, Inc. |

| Morningstar, Inc. |

| NETGEAR, INC |

| NEUSTAR INC |

| NEW RELIC INC |

| NOVANTA INC |

| OCLARO, INC. |

| OMNICELL, Inc |

| PLANTRONICS INC /CA/ |

| PLEXUS CORP |

| Premier, Inc. |

| Presidio, Inc. |

| PROS HOLDINGS, INC. |

| Pure Storage, Inc. |

| Q2 Holdings, Inc. |

| QUEBECOR, INC. |

| RAMBUS INC |

| REALPAGE INC |

| SANMINA CORP |

| SEMTECH CORP |

| SENDGRID, INC. |

| SILICON LABORATORIES INC |

| SOLAREDGE TECHNOLOGIES INC |

| SPS COMMERCE INC |

| SYKES ENTERPRISES INC |

| SYNAPTICS INC |

| SYSTEMAX INC |

| TECH DATA CORP |

| TIVO CORP |

| TrueCar, Inc. |

| TTM TECHNOLOGIES INC |

| UNITED STATES CELLULAR CORP |

| VARONIS SYSTEMS INC |

| VIASAT INC |

| VISHAY INTERTECHNOLOGY INC |

| VONAGE HOLDINGS CORP |

| WebMD Health Corp. |

| WEST CORP |

| WORKIVA INC |

| XPERI CORP |

| ZYNGA INC |

| Company |

| ALLSCRIPTS HEALTHCARE SOLUTIONS, INC. |

| BOX INC |

| DESCARTES SYSTEMS GROUP INC |

| DUN & BRADSTREET CORP/NW |

| FireEye, Inc. |

| HUBSPOT INC |

| Inovalon Holdings, Inc. |

| J2 GLOBAL, INC. |

| JABIL INC |

| MANTECH INTERNATIONAL CORP |

| MENTOR GRAPHICS CORP |

| Morningstar, Inc. |

| NEW RELIC INC |

| Pure Storage, Inc. |

| Quotient Technology Inc. |

| Sailpoint Technologies Holdings, Inc. |

| VIASAT INC |

| WEST CORP |

| Company |

| 2U, Inc. |

| ACI WORLDWIDE, INC. |

| AVX Corp |

| BOINGO WIRELESS INC |

| CABOT MICROELECTRONICS CORP |

| CALLIDUS SOFTWARE INC |

| CIENA CORP |

| Casa Systems Inc |

| Cornerstone OnDemand Inc |

| DUN & BRADSTREET CORP/NW |

| ETSY INC |

| FINISAR CORP |

| Gigamon Inc. |

| Gigamon Inc. |

| INNOVIVA, INC. |

| Inovalon Holdings, Inc. |

| MICROSTRATEGY INC |

| MINDBODY, Inc. |

| PEGASYSTEMS INC |

| Presidio, Inc. |

| Q2 Holdings, Inc. |

| ROGERS CORP |

| SILICON LABORATORIES INC |

| Straight Path Communications Inc. |

| UNITED STATES CELLULAR CORP |

| VISHAY INTERTECHNOLOGY INC |

| VONAGE HOLDINGS CORP |

45

| Company |

| 2U, Inc. |

| BOINGO WIRELESS INC |

| BROADSOFT, INC. |

| CABOT MICROELECTRONICS CORP |

| MENTOR GRAPHICS CORP |

| GameStop Corp. |

| TrueCar, Inc. |

ANNEX

| Company |

| 8X8 INC /DE/ |

| ALLSCRIPTS HEALTHCARE SOLUTIONS, INC. |

| Alarm.com Holdings, Inc. |

| BENCHMARK ELECTRONICS INC |

| BOINGO WIRELESS INC |

| CSG SYSTEMS INTERNATIONAL INC |

| Casa Systems Inc |

| DESCARTES SYSTEMS GROUP INC |

| FINISAR CORP |

| Groupon, Inc. |

| HEALTHEQUITY INC |

| INTERSIL CORP/DE |

| KINAXIS INC. |

| MACOM TECHNOLOGY SOLUTIONS HOLDINGS, INC. |

| MULESOFT, INC |

| NETGEAR, INC |

| NEW RELIC INC |

| PLANTRONICS INC /CA/ |

| Q2 Holdings, Inc. |

| QUALYS, INC. |

| SILICON LABORATORIES INC |

| SYNAPTICS INC |

| UNITED STATES CELLULAR CORP |

| VONAGE HOLDINGS CORP |

| XPERI CORP |

| For the Year Ended December 31, 2017 | Stock-Based | Intangible | Executive | One-time | Debt | |||||||||||

| All amounts in millions except | GAAP | Compen-sation | Amorti-zation | Consulting | Insurance | Amorti-zation | Income Tax | Non-GAAP | ||||||||

| per share data: | Amounts | Expense | Expense | Expenses | Proceeds | Expense | Adjustments | Amounts | ||||||||

| Cost of Revenues | $ 79.23 | $ 1.77 | 0 | 0 | 0 | 0 | 0 | $ 77.45 | ||||||||

| Research & Development | 46.21 | 9.03 | 0 | 0 | 0 | 0 | 0 | 37.17 | ||||||||

| Sales & Marketing | 91.22 | 7.29 | 0 | 0 | 0 | 0 | 0 | 83.93 | ||||||||

| General & Administrative | 88.55 | 22.73 | 15.99 | 6.00 | (1.86) | 0 | 0 | 45.68 | ||||||||